SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

x | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨ | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to Section 240.14a-12 | | |

The Charles Schwab Corporation

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee previously paid with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Preliminary Copy

THECHARLESSCHWABCORPORATION 2006PROXYSTATEMENT2012 Proxy Statement

Preliminary Copy

March 30, 2006

2012

Dear Fellow Stockholders,

We cordially invite you to attend our 2006 annual meeting2012 Annual Meeting of stockholders. The meeting willStockholders to be held on Thursday, May 18, 2006,17, 2012, at 2:00 p.m., Pacific Time,Time. We are pleased to host our annual meeting as a virtual event at www.schwabevents.com/corporation. You also may attend the Argent Hotel, 50 Thirdmeeting in person at 211 Main Street, San Francisco, California.

If you plan to attend the meeting virtually via the internet or in person, please follow the registration instructions as outlined in this proxy statement.

At the annual meeting, we will:

· | | elect three directors for three-year terms, |

· | | vote on a proposal to amend the certificate of incorporation and bylaws to provide for the annual election of directors, |

· | | vote on four stockholder proposals, and |

· | | consider any other business properly coming before the meeting. |

will conduct the items of business outlined in this proxy statement. We also will report on our corporate performance in 20052011 and answer your questions.

Your vote is important. We are pleasedencourage you to offerread this proxy statement carefully and to vote your shares as soon as possible, even if you the convenience of viewing our annual meeting by webcast atwww.schwabevents.com. If you preferplan to attend the meeting in person, please followmeeting. Voting instructions are contained on the advance registration instructions as outlined inproxy card or voting instruction form that you received with this proxy statement, as you will need a ticket for admission. statement.

We look forward to your participation.

Sincerely,

| | |

| |

CHARLES R. SCHWAB

CHAIRMAN AND CHIEF EXECUTIVE OFFICER

| |

|

| |

| CHARLES R. SCHWAB | | WALTER W. BETTINGER II |

| CHAIRMAN | | PRESIDENT AND CHIEF EXECUTIVE OFFICER |

Preliminary Copy

TABLE OF CONTENTS

i

Preliminary Copy

TABLE OF CONTENTS

i

PROXY SUMMARY

This summary highlights information contained elsewhere in the proxy statement. This summary does not contain all of the information that you should consider, and you should review all of the information contained in the proxy statement before voting.

ANNUAL MEETING OF STOCKHOLDERS

VOTING PROPOSALS

| | | | | | |

| | Board Recommendation | | Page | |

Election of Directors | | | | | | |

Nancy H. Bechtle | | For | | | 2 | |

Walter W. Bettinger II | | For | | | 2 | |

C. Preston Butcher | | For | | | 2 | |

Ratification of Independent Auditors | | For | | | 13 | |

Advisory Approval of Named Executive Officer Compensation | | For | | | 16 | |

Proposal to amend Certificate of Incorporation and Bylaws to Declassify the Board | | For | | | 46 | |

Stockholder Proposal on Political Contributions | | Against | | | 51 | |

Stockholder Proposal to amend Bylaws regarding Proxy Access | | Against | | | 52 |

Exhibit E: Description of Alan J. Weber’s Separation Agreement

| | 53 |

DIRECTOR NOMINEES

We ask that you vote for the election of Nancy H. Bechtle, Walter W. Bettinger II, and C. Preston Butcher. The following table provides summary information on these nominees; complete biographical information is contained in the proxy statement.

| | | | | | | | | | | | | | | | | | |

| Name | | Age | | | Director

Since | | | Occupation | | Skills | | Independent | | | Committees |

Nancy H. Bechtle | | | 74 | | | | 1992 | | | Chairman, Sugar Bowl Corporation | | Finance

Leadership | | | X | | | Nominating

Compensation |

| | | | | | |

Walter W. Bettinger II | | | 51 | | | | 2008 | | | President and Chief Executive Officer, The Charles Schwab Corporation | | Financial

ServicesLeadership Strategic | | | | | | |

| | | | | | |

C. Preston Butcher | | | 73 | | | | 1988 | | | Chairman and Chief Executive Officer, Legacy Partners | | Finance

Leadership | | | X | | | Nominating

Audit |

ii

INDEPENDENT AUDITORS

We ask that you ratify the appointment of Deloitte & Touche LLP and the member firms of Deloitte Touche Tohmatsu (collectively referred to as “Deloitte”) as the company’s independent registered public accounting firm for the 2012 fiscal year. While the Audit Committee has the sole authority to retain the independent auditors, we are asking for your ratification as part of the Audit Committee’s evaluation process of the independent registered public accounting firm for the next fiscal year.

Fees for services provided by Deloitte in the last two fiscal years were:

| | | | | | | | |

| | | 2011 | | | 2010 | |

| | | (amounts in millions) | |

Audit Fees | | $ | 5.2 | | | $ | 4.4 | |

| | |

Audit-Related Fees | | | 1.8 | | | | 1.8 | |

| | |

Tax Fees | | | 0.1 | | | | 0.1 | |

| | |

All Other Fees | | | None | | | | None | |

| | |

Total | | $ | 7.1 | | | $ | 6.3 | |

EXECUTIVE COMPENSATION

We ask you to approve on an advisory basis the compensation of our named executive officers, i.e., the Chief Executive Officer, the Chief Financial Officer, and the next three most highly compensated executive officers. The advisory approval of named executive officer compensation is required by federal law, and while the vote is not binding, the Compensation Committee considers the vote as part of its evaluation of executive compensation programs.

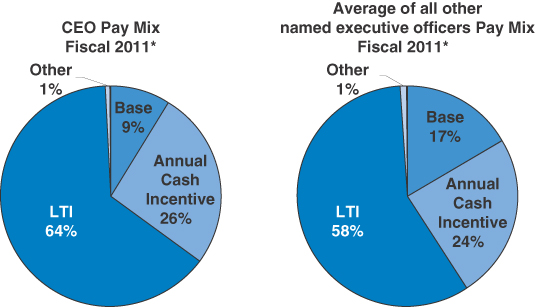

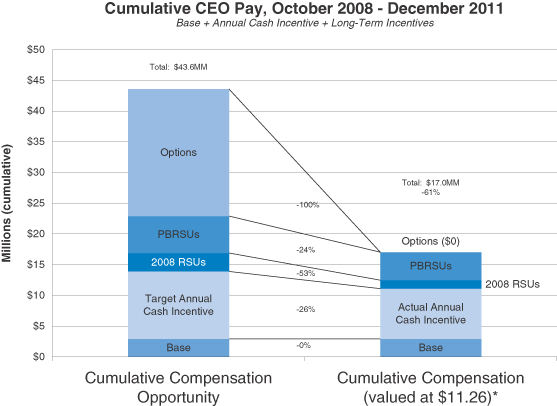

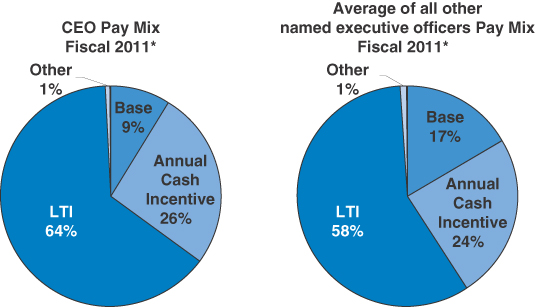

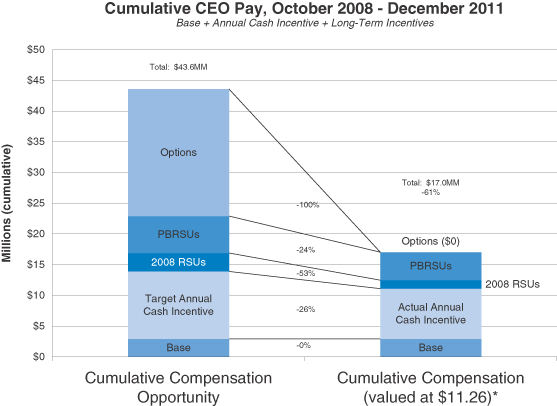

2011 Executive Compensation Highlights

In 2011, our management team continued to position the company for future growth, invest in clients, and sustain expense discipline, which resulted in a pretax profit margin of 29.7% and return on stockholders’ equity of 12%.

iii

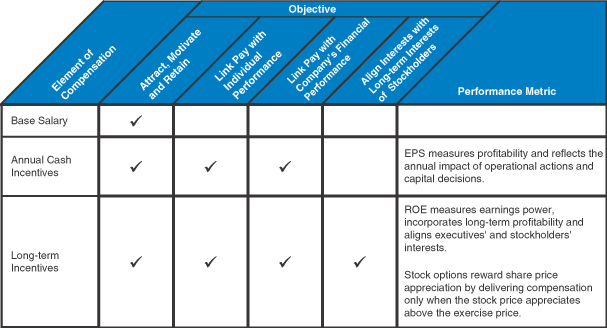

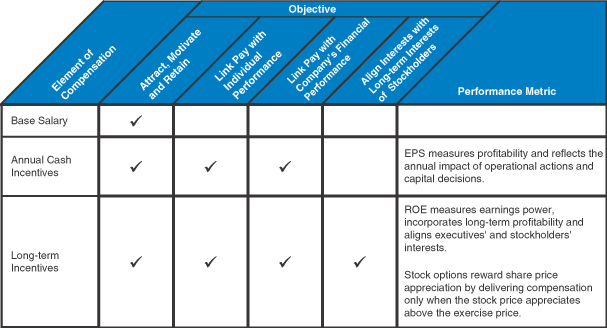

The company’s compensation programs are designed to link pay to the long-term performance of the company. Key elements of compensation include:

| | | | | | |

| Element | | Form | | Terms | | Objectives |

| | | |

Base Salary | | · Cash | | · Reviewed annually | | · Attract, motivate and retain executives |

| | | |

Annual Incentives | | · Cash | | · Subject to satisfaction of performance criteria | | · Attract, motivate and retain executives · Link pay with individual performance · Link pay with company financial performance |

| | | |

Long-Term Incentives | | · Performance-based restricted stock units | | · Restricted stock units vest 25% per year subject to satisfaction of performance criteria | | · Attract, motivate and retain executives · Link pay with individual performance |

| | | |

| | · Stock options | | · Stock options generally vest 25% per year and have a 10 year term | | · Link pay with company financial performance · Align with long-term interests of stockholders |

In 2011, the target for annual incentive compensation was set at earnings per share levels achieved prior to the onset of the financial crisis. Financial performance in 2011 supported a payout below this aggressive target, at 78% of the target award. The performance goal for performance-based restricted stock units was set as return on equity exceeding the cost of equity to align the executives’ interests with long-term interests of stockholders. These units vest only if the performance goals are satisfied for the annual performance period or the cumulative four-year performance period.

Preliminary Copyiv

Summary compensation information for the named executive officers in 2011 is contained in the following table. As discussed in the proxy statement, these amounts are presented in accordance with accounting assumptions and Securities and Exchange Commission rules, and the amount that the executive actually receives may vary substantially from what is reported in the equity columns of the table.

2011 SUMMARY COMPENSATION

| | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal

Position | | Salary

($) | | | Stock

Awards

($) | | | Option

Awards

($) | | | Non-Equity

Incentive Plan

Compensation

($) | | | All Other

Compensation

($) | | | Total

($) | |

| | | | | | |

Walter W. Bettinger II PRESIDENT AND CHIEF

EXECUTIVE OFFICER | | | 900,000 | | | | 1,950,000 | | | | 4,550,000 | | | | 2,632,500 | | | | 71,877 | | | | 10,104,377 | |

| | | | | | |

Joseph R. Martinetto CHIEF FINANCIAL OFFICER | | | 497,667 | | | | 390,000 | | | | 910,000 | | | | 582,269 | | | | 19,564 | | | | 2,399,500 | |

| | | | | | |

Benjamin L. Brigeman EXECUTIVE VICE PRESIDENT –

INVESTOR SERVICES | | | 543,500 | | | | 450,000 | | | | 1,050,000 | | | | 741,877 | | | | 21,627 | | | | 2,807,004 | |

| | | | | | |

James D. McCool EXECUTIVE VICE PRESIDENT –

INSTITUTIONAL SERVICES | | | 522,667 | | | | 420,000 | | | | 980,000 | | | | 713,440 | | | | 47,462 | | | | 2,683,569 | |

| | | | | | |

Charles R. Schwab CHAIRMAN | | | 500,000 | | | | 900,000 | | | | 2,100,000 | | | | 975,000 | | | | 42,979 | | | | 4,517,979 | |

OTHER PROPOSALS

For a description of our proposal regarding declassification of the Board of Directors and the two stockholder proposals, and our reasons for our recommendation on each proposal, please see the information contained within the proxy statement.

v

NOTICE OF 20062012 ANNUAL MEETING OF STOCKHOLDERS

The 2006 annual meeting2012 Annual Meeting of stockholdersStockholders of The Charles Schwab Corporation will be held as a virtual event on Thursday, May 18, 2006,17, 2012, at 2:00 p.m., Pacific Time, at the Argent Hotel, 50 Thirdwww.schwabevents.com/corporation. You also may attend in person at 211 Main Street, San Francisco, California, toCalifornia. At the annual meeting, we will conduct the following items of business:

| · | | elect three directors for three-year terms, |

| · | | vote to ratify the selection of independent auditors, |

| · | | vote for the approval, on a proposalan advisory basis, of compensation of named executive officers, |

| · | | vote to amend the certificate of incorporation and bylaws to provide fordeclassify the annual election of directors,board, |

| · | | vote on fourtwo stockholder proposals, and |

| · | | consider any other business properly coming before the meeting. |

Stockholders who owned shares of our common stock at the close of business on March 20, 200619, 2012 are entitled to attend and vote at the meeting and any adjournment or postponement of the meeting. A complete list of registered stockholders will be available prior to the meeting at our principal executive offices at 120 Kearny211 Main Street, San Francisco, California 94108.94105.

|

By Order of the Board of Directors, |

|

|

| CARRIE E. DWYER |

| EXECUTIVE VICE PRESIDENT, |

| GENERAL COUNSEL AND |

| CORPORATE SECRETARY |

Important Notice Regarding the Availability of Proxy Materials for the BoardAnnual Meeting of Directors,

Stockholders to be Held on May 17, 2012. The proxy statement and annual report to

www.aboutschwab.com.

Your Vote is Important

Please vote as promptly as possible by following the instructions on your proxy card or voting

instruction form. If you plan to attend the meeting virtually via the internet or in person, you must

register by following the instructions contained in the “Information about the Annual Meeting”

section of this proxy statement.

CARRIE E. DWYERvi

EXECUTIVE VICE PRESIDENT,

GENERAL COUNSEL AND

CORPORATE SECRETARY

iii

Preliminary CopyINFORMATION ABOUT THE ANNUAL MEETING

VOTING YOUR SHARES

Thisproxy statement describes the proposals on which you may vote as a stockholder of The Charles Schwab Corporation. It contains essential information to consider when voting.

We, the company’s Board of Directors areis sending these proxy materials to you on or about March 30, 2006.

VOTING YOUR SHARES

2012. Stockholders who owned the company’s common stock at the close of business on March 20, 200619, 2012 may attend and vote at the annual meeting. Each share is entitled to one vote. There were shares of common stock outstanding on March 20, 2006.

19, 2012.

How do I vote?register for the annual meeting?

ü | | You may vote on the Internet. |

You do this by followingmust register in advance to attend the “Vote by Internet” instructions that came with your proxy statement. Ifannual meeting in person or virtually via the internet. While you may watch the webcast without registering, you will not be able to access the area of the website where you can ask questions and vote on the Internet,if you do not haveregister.

To register to mailattend the annual meeting in your proxy card.person or virtually via the internet, please go to:

ü | | You may vote by telephone. |

www.schwabevents.com/corporation.

You dowill be asked to provide your name, complete mailing address, email address and proof that you own Schwab shares (such as the Schwab account number in which you hold the shares, or the name of the broker and number of shares that you hold in an account outside of Schwab).

You also may write the Assistant Corporate Secretary at the address in the “Corporate Governance Information” section of this by followingproxy statement or call the “Vote by Telephone” instructions that came with your proxy statement. Assistant Corporate Secretary at (415) 667-9979 if you plan to attend the in-person meeting.

How may I vote shares at the annual meeting?

If you vote by telephone, you do not have to mail in your proxy card.

You do this by completing and signing your proxy card and mailing it in the enclosed prepaid and addressed envelope.

ü | | You may vote in person at the meeting. |

We will pass out written ballots to anyone who wants to vote in person at the meeting. However, if you hold your shares in street name, you must request a proxy from your stockbroker in orderplan to vote at the meeting. Holdingannual meeting and your shares are held in “street name” means(e.g., through a bank or broker), you will need a legal proxy to vote your shares at the annual meeting. You may obtain a legal proxy from your bank or broker. If you plan to vote at the virtual meeting, please send your legal proxy to our transfer agent, Wells Fargo Bank, N.A., by fax to (651) 450-4026 or email to wfssproxyteam@wellsfargo.com. If you plan to vote at the in-person meeting, you may bring the legal proxy with you.

If you hold them throughshares registered in your name (e.g., in certificate form), you will not need a brokerage firm, banklegal proxy to vote your shares.

How do I access the virtual annual meeting?

To access the virtual annual meeting, please go to:

www.schwabevents.com/corporation.

If you register in advance to attend the annual meeting, we will email you information on how to access the area of the virtual meeting where you will be able to submit questions and vote.

How do I attend the in-person meeting?

If you plan to attend the in-person meeting, in accordance with our security procedures, you will be asked to present picture identification to enter the meeting. Attendance at the annual meeting is limited to stockholders or other nominee,one named representative of a stockholder. Seating is limited and, therefore, admission to the shares are not held inannual meeting is on a first-come, first-served basis. If you will be naming a representative to attend the meeting on your behalf, the name, address and telephone number of that individual name.must also be provided.

What am I voting on?

We are asking you to vote:

· | | forthe election of three directors for terms of three years, |

· | | for the proposal to amend the certificate of incorporation and bylaws to provide for the annual election of directors, and |

· | | against the four stockholder proposals. |

1

PROPOSALS TO VOTE ONPROPOSAL ONE:

ELECTION OF DIRECTORS

Nominees for directors this year are:

| · | | C. Preston ButcherWalter W. Bettinger II |

| · | | Marjorie MagnerC. Preston Butcher |

Each nominee is presently a director of the company and has consented to serve a three-year term.

We recommend a votefor these nominees.

APPROVAL OF AMENDMENTS TO THE CERTIFICATE OF INCORPORATION AND BYLAWS

Our board is currently divided into three classes having three-year terms. The company’s stockholders approved the election of directors by classes in 1996. Stockholders voted in favor of a classified board at that time to ensure the continuity and stability Biographical information about each of the company’s directors and policies, so that a majority of directors at any given time would have prior experience as directors of the company.

While we believe that such continuitynominees is still a valid concern, the Nominating and Corporate Governance Committee reevaluated our board structurecontained in light of the level of support received for the stockholder proposal calling for the annual election of directors submitted last year by William C. Thompson, Jr., Comptroller, City of New York, on behalf of the Boards of Trustees of the New York City Pension Funds (approximately 57% of votes cast on the proposal). After careful deliberation and evaluation by both the Nominating and Corporate Governance Committee and the Board of Directors, our board approved submitting a proposal to amend the certificate of incorporation and bylaws to provide for the annual election of directors, beginning at the 2007 annual meeting.

To ensure a smooth transition to the system of annual election of the entire board, annual elections would be phased in as current terms expire. Directors elected atthe 2004 and 2005 annual meetings would serve the remainder of their three-year terms until 2007 and 2008, respectively, and annual elections would begin for those directors upon expiration of their terms. All directors (including directors elected at this year’s annual meeting) would be elected annually beginning in 2009. Directors elected by the board to fill vacancies prior to 2009 would serve for the remainder of the term of the class to which the director is elected.

The proposed amendments would delete, beginning with the complete declassification of the board in 2009, the existing requirement that provides, in accordance with the provisions of Delaware law applicable to classified boards of directors, that directors may be removed only for cause. Under Delaware law, directors of companies that do not have classified boards may be removed by stockholders with or without cause. The proposed amendments, if passed, also would eliminate the requirement that the affirmative vote of 80% of all outstanding shares of common stock is necessary to amend the provisions concerning the terms of directors.

The proposed amendments to the company’s Fifth Restated Certificate of Incorporation and Third Restated Bylaws are attached to this proxy statement as Exhibit A.

The affirmative vote of 80% of the outstanding shares of common stock is required for approval of this proposal.

We recommend a votefor the approval of the amendments to the certificate of incorporation and bylaws.

2

PROPOSALS TO VOTE ON

STOCKHOLDER PROPOSALS

We have been notified that several stockholders intend to present proposals for consideration at the annual meeting. The stockholder proposals and supporting statements appear in italics below, and we present the proposals as they were submitted to us. Our responses are contained immediately after each proposal.

FIRST STOCKHOLDER PROPOSAL:

THE EFFECT OF A FLAT TAX

Thomas J. Borelli, 173 Oakland Avenue, Eastchester, NY 10709, who holds approximately 233 shares of company stock, has submitted the following proposal for consideration at the annual meeting.

Stockholder Resolution

Whereas:

Charles Schwab & Co., Inc.’s primary responsibility is to create value for shareholders and should pursue legal and ethical means to achieve that goal, including identifying public policies that would advance shareholder value in a transparent and lawful manner. [See National Legal and Policy Center, www.nlpc.org/cip.asp and Free Enterprise Action Fund, http://www.FreeEnterpriseActionFund.com/about.html]

Whereas:

Company profitability and shareholder value are significantly affected by the federal tax code.

The current federal corporate income tax is complex, costly, and burdensome for businesses and shareholders. The number of pages of federal tax laws and regulations exceed 50,000. Annual tax compliance costs are estimated to range from $100 billion and $200 billion.

The U.S. has the second-highest corporate tax rate among 69 countries [See Chris Edwards, “Corporate Tax Reform,” Cato Institute Tax & Budget Bulletin No. 21, September 2004, www.cato.org/pubs/tbb/tbb-0409-21.pdf.]

Tax reform is crucial to America’s business competitiveness. In 2005, the President’s Advisory Panel on Tax Reform developed proposals for simplifying the federal tax system to: reduce compliance costs and burdens to businesses andindividuals; promote economic growth and job creation; encourage capital investment; and to strengthen the ability of U.S. companies to compete in foreign markets.

Other tax reform proposals include the “flat tax” proposed in the book entitled “Flat Tax Revolution: Using a Postcard to Abolish the IRS” (Regnery, 2005) by Steve Forbes.

Whereas:

Schwab and its shareholders may significantly benefit from significant reform of the federal tax code, such as by replacing the current federal income tax with a flat tax.

Resolved: Schwab’s shareholders request that, by the 2006 annual shareholder meeting, the Board of Directors make available to shareholders a report on the estimated impacts of a flat tax for Schwab, omitting proprietary information and at a reasonable cost.

The report should provide estimates of the impact to Schwab of:

1. | | Taxing all profits at a flat rate of 17 percent and at other alternative flat rates; |

2. | | Limiting taxable income to only income earned in the U.S.; |

3. | | Replacing depreciation with capital expensing; |

4. | | Abolishing special “preferences” or “loopholes” in the corporate tax code; |

5. | | Savings attained from reduced business compliance costs. |

Stockholder’s Statement of Support

The flat tax might benefit Schwab and its shareholders by:

1. | | Increasing corporate dividend payouts to shareholders; |

2. | | Reducing corporate tax accounting, planning and compliance costs; |

3. | | Reducing incentives for questionable tax avoidance schemes that could backfire and attract litigation and penalties from federal authorities; |

4. | | Increasing transparency in accounting and improved planning for investment and other activities; |

3

PROPOSALS TO VOTE ON

5. | | Spurring economic activity and growth, which might further increase company revenue, expand the financial services industry and increase shareholder value. |

For more information:

1. | | Chris Edwards, “Options for Tax Reform,” Policy Analysis No. 536, Cato Institute: Washington, DC, February 24, 2005. |

2. | | “The Flat Tax: Issue Home Page,” Freedom Works, http://www.freedomworks.org. |

3. | | Daniel Mitchell, “Making American Companies More Competitive,” Backgrounder 1691, Heritage Foundation: Washington, DC, September 25, 2003. |

Board of Directors’ Recommendation Against and Statement of Opposition to the Proposal Regarding the Effect of a Flat Tax

We do not believe that the annual meeting is an appropriate forum for political debates such as the rate of taxation. Nor do we believe that preparing such analyses on the effect of a flat tax is an effective use of company resources or stockholders’ equity.

We recommend a voteagainstthe stockholder proposal regarding the effect of a flat tax.

SECOND STOCKHOLDER PROPOSAL:

POLITICAL CONTRIBUTIONS

The International Brotherhood of Teamsters, 25 Louisiana Avenue NW, Washington, D.C. 20001, which holds approximately 1,400 shares of company stock, has submitted the following proposal for consideration at the annual meeting.

Stockholder Resolution

Resolved, that the shareholders of The Charles Schwab Corporation (“Charles Schwab,” “Schwab” or the “Company”) hereby request that the Company provide a report, updated semi-annually, disclosing the Company’s:

1. | | Policies and procedures for political contributions (both direct and indirect) made with corporate funds. |

2. | | Monetary and non-monetary contributions to political candidates, political parties, political committees andother political entities organized and operating under26USC Sec. 527 of the Internal Revenue Code including the following: |

a. | | An accounting of the Company’s funds contributed to any of the organizations described above; |

b. | | Identification of the person or persons in the Company who participated in making the decisions to contribute; and, |

c. | | The internal guidelines or policies, if any, governing the Company’s political contributions. |

This report shall be presented to the Board of Directors’ Audit Committee or other relevant oversight committee, and posted on the Company’s website.

Stockholder’s Statement of Support

As long-term shareholders of Charles Schwab, we [The International Brotherhood of Teamsters] support policies that apply transparency and accountability to corporate political giving. In our view, such disclosure is consistent with public policy in regard to public company disclosure. Absent a system of accountability, we believe that corporate executives will be free to use the Company’s assets for political objectives that are not shared by and may be inimical to the interests of the Company and its shareholders. We are concerned that there is currently no single source of information that provides all of the information sought by this resolution.

Working Americans do business with our Company as brokerage clients. They invest their retirement savings through Charles Schwab and own shares in the Company itself. We believe these relationships are based on the expectation of trust in Charles Schwab. In our view, this trust is imperiled by Schwab’s partisan role in the national debate on Social Security, which affects the retirement security of the Company’s depositors and investors. For this reason, we believe that complete disclosure by the Company is necessary for the Board and its shareholders to be able to fully evaluate the political use of corporate assets.

4

PROPOSALS TO VOTE ON

Our Company has been a member of the Alliance for Worker Retirement Security, which is in our opinion the main business-backed lobby group for privatization of Social Security. Our Company also donated to the Cato Institute (Cleveland Plain Dealer, 12/19/99), the think tank that in our view has moved privatization from the political fringe to the mainstream, and Chairman and CEO Charles R. Schwab has personally contributed to the Club for Growth, which pledged to spend $10 million to promote privatization (Houston Chronicle, 2/14/05).

We believe that Schwab’s support for these groups creates a serious potential conflict of interest between the Company’s own interest in profits from managing private accounts and the interest of its clients in preserving Social Security in its current form. Particularly under these circumstances, we believe that the Company should fully disclose to its shareholders all political contributions identified in this proposal.

We urge your support FOR this critical governance reform.

Board of Directors’ Recommendation Against and Statement of Opposition to the Proposal Regarding Political Contributions

Please see our statement in opposition to the proposal regarding the effect of a flat tax, above. In addition, we note that in 2005, the company made the following contributions to the types of organizations listed in the stockholder’s resolution:

| | | |

| Organization | | Amount |

| |

Committee on Jobs Government Reform Fund (SF non-partisan business association involved in civic affairs) | | $ | 35,000 |

| |

San Francisco Chamber of Commerce 21st Century Fund | | $ | 10,000 |

| |

Bay Area Democrats | | $ | 10,000 |

| |

Total | | $ | 55,000 |

We believe that our current policies advance the interests of the company’s stockholders and clients and that theminimal funding contributed to organizations listed above is a better use of company resources (generally in support of communities in which we live) than the expense of implementing this stockholder proposal.

We recommend a voteagainst the stockholder proposal regarding political contributions.

THIRD STOCKHOLDER PROPOSAL:

MAJORITY VOTING

The Sheet Metal Workers’ National Pension Fund, Edward F. Carlough Plaza, 601 N. Fairfax Street, Suite 500, Alexandria, VA 22314 which holds approximately 32,950 shares of company stock, has submitted the following proposal for consideration at the annual meeting.

Stockholder Resolution

Resolved: That the shareholders of Charles Schwab (“Company”) hereby request that the Board of Directors initiate the appropriate process to amend the Company’s governance documents (certificate of incorporation or bylaws) to provide that director nominees shall be elected by the affirmative vote of the majority of votes cast at an annual meeting of shareholders.

Stockholder’s Statement of Support

Our Company is incorporated in Delaware. Delaware law provides that a company’s certificate of incorporation or bylaws may specify the number of votes that shall be necessary for the transaction of any business, including the election of directors. (DGCL, Title 8, Chapter 1, Subchapter VII, Section 216). The law provides that if the level of voting support necessary for a specific action is not specified in a corporation’s certificate or bylaws, directors “shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors.”

Our Company presently uses the plurality vote standard to elect directors. This proposal requests that the Board initiate a change in the Company’s director election vote

5

PROPOSALS TO VOTE ON

standard to provide that nominees for the board of directors must receive a majority of the vote cast in order to be elected or re-elected to the Board.

We [The Sheet Metal Workers] believe that a majority standard in director elections would give shareholders a meaningful role in the director election process. Under the Company’s current standard, a nominee in a director election can be elected with as little as a single affirmative vote, even if a substantial majority of the votes cast are “withheld” from that nominee. The majority vote standard would require that a director receive a majority of the vote cast in order to be elected to the Board.

The majority vote proposal received high levels of support last year, winning majority support at Advanced Micro Devices, Freeport McMoRan, Marathon Oil, Marsh & McLennan, Office Depot, Raytheon, and others. Leading proxy advisory firms recommended voting in favor of the proposal.

Some companies have adopted board governance policies requiring director nominees that fail to receive majority support from shareholders to tender their resignations to the board. We believe that these policies are inadequate for they are based on continued use of the plurality standard and would allow director nominees to be elected despite only minimal shareholder support. We contend that changing the legal standard to a majority vote is a superior solution that merits shareholder support.

Our proposal is not intended to limit the judgment of the Board in crafting requested governance change. For instance, the Board should address the status of incumbent director nominees who fail to receive a majority vote under a majority vote standard and whether a plurality vote standard may be appropriate in director elections when the number of director nominees exceeds the available board seats.

We urge your support of this important director election reform.

Board of Directors’ Recommendation Against and Statement of Opposition to the Proposal Regarding Majority Voting

While majority voting has been a highly debated topic in the investment community, we believe that it would be premature to vote on this proposal until stockholders know and can consider the outcome of the company’s proposal regarding declassification of the board. Whether or not directors continue to be elected to three-year terms is significant in deciding how to vote on this proposal, because the consequences of failing to receive a majority vote vary significantly, depending on whether the director has a one-year or three-year term.

The company is incorporated in Delaware. If this proposal were to pass, under Delaware law, a director failing to receive a majority vote (but still receiving a plurality of votes) would continue to serve “…until such director’s successor is elected and qualified.” Delaware General Corporation Law Section 141(b). This is known as a “holdover” term. If the company’s proposal regarding declassification of the board passes, and directors are elected to one-year terms, a director who fails to receive a majority vote would continue to serve with a holdover term of one year. If, however, the company’s proposal is defeated, and the board remains classified, a director would serve a holdover term of three years.

In addition, the company’s proposal to declassify the board, upon completion of declassification, would eliminate the Delaware law requirement that directors on classified boards be removed in the middle of their terms only for cause. Delaware General Corporation Law Section 141(k). If the current proposal to adopt majority voting were approved but the company’s proposal to declassify the board were rejected, absent a showing of cause, a director could not be removed who fails to garner majority support (such failure alone would not constitute “cause”). We will need to consider the effects of Delaware law in considering any potential change to voting procedures, which may limit our ability to implement this proposal.

6

PROPOSALS TO VOTE ON

Before deciding whether or not to vote on a majority standard for the election of directors, we believe that it is important for stockholders to know what the effect will be on (1) the length of director “holdover” terms for directors who fail to receive a majority vote and (2) whether directors who are elected may be removed with or without cause during their terms. This is important information that may influence how a stockholder would vote on this proposal.

We recommend a voteagainst the stockholder proposal regarding majority voting.

FOURTH STOCKHOLDER PROPOSAL:

SEVERANCE PAYMENTS

The Trowel Trades S&P 500 Index Fund of the International Union of Bricklayers and Allied Craftworkers, P.O. Box 75000, Detroit, Michigan 48275, which holds approximately 35,381 shares of company stock, has submitted the following proposal for consideration at the annual meeting.

Stockholder Resolution

Resolved: that the shareholders of The Charles Schwab Corporation (“the Company”) urge the Board of Directors to seek shareholder approval of future severance agreements with senior executives that provide benefits in an amount exceeding 2.99 times the sum of the executives’ base salary plus bonus. “Future severance agreements” include employment agreements containing severance provisions, retirement agreements and agreements renewing, modifying or extending existing such agreements. “Benefits” include lump-sum cash payments and the estimated present value of periodic retirement payments, fringe benefits, perquisites and consulting fees to be paid to the executive.

Stockholder’s Statement of Support

In our [The Trowel Trades S&P 500 Index Fund’s] opinion, severance agreements as described in this resolution, commonly known as “golden parachutes”, are excessive in light of the high levels of compensation enjoyedby senior executives at the Company and U.S. corporations in general.

We believe that requiring shareholder approval of such agreements may have the beneficial effect of insulating the Board of Directors from manipulation in the event a senior executive’s employment must be terminated by the Company. Because it is not always practical to obtain prior shareholder approval, the Company would have the option if this proposal were implemented of seeking shareholder approval after the material terms of the agreement were agreed upon.

For those reasons, we urge shareholders to vote for this proposal.

Board of Directors’ Recommendation Against and Statement of Opposition to the Proposal Regarding Severance Payments

The company’s severance agreements and policies are part of the company’s overall compensation program, one designed to attract and retain highly qualified executives. The company operates in a highly competitive industry where executive talent is in high demand. We believe that this proposal would tie the hands of company management and the Compensation Committee in negotiating severance agreements they deem to be in the best interests of the company and its stockholders. The Compensation Committee is responsible for overseeing and administering the company’s compensation programs, including severance arrangements, for senior executives. The committee is composed entirely of independent directors and has access to an independent compensation consultant to assist it with making compensation decisions. The committee reviews the terms of senior executive separation agreements (that are not part of the company’s Severance Pay Plan) for fairness and comparability to similarly situated companies. The company’s overall philosophy regarding executive compensation is described in the Compensation Committee Report in this proxy statement.

7

PROPOSALS TO VOTE ON

We believe that implementing this proposal will be costly and disruptive to our executive recruiting and retention efforts. In order to hire the best person for the job, the company will sometimes need to act decisively and within a short time frame. Under this proposal, however, in order to ratify a severance agreement with a potential executive, the company would either have to call a special meeting of stockholders or wait until the next occurring annual meeting of stockholders, neither of which is realistic in the context of a hiring situation. While the proposal’s supporting statement argues that the company could seek stockholder approval after the material terms are agreed, this does not provide any assurance to a potential senior executive that the employment and severance package he or she has negotiated will be honored by the company. The executive would be in the position of having to accept employment with the company (and perhaps resigning from another company) without knowing what his or her total compensation package would be. We strongly believe this would place the company at a disadvantage relative to its competitors.

We continue to believe that the company and its stockholders are best served by having compensation decisions, including severance arrangements, made by a Compensation Committee composed entirely of independent directors, charged with the fiduciary duty to make decisions in the best interests of the company and its stockholders, and taking into account all relevant factors.

We recommend a voteagainst the stockholder proposal regarding severance payments.

OTHER BUSINESS

We know of no other business to be considered at the meeting. However, if:

· | | other matters are properly presented at the meeting, or at any adjournment or postponement of the meeting, and |

· | | you have properly submitted your proxy, |

then Charles R. Schwab and Carrie E. Dwyer will vote your shares on those matters according to their best judgment.

8

THE BOARD OF DIRECTORS

section.

MEMBERS OF THE BOARD OF DIRECTORS

WILLIAM F. ALDINGER III

DIRECTOR SINCE JULY 2005

Mr. Aldinger, age 58, was Chairman and Chief Executive Officer of HSBC North America Holdings Inc., a financial services company, from 2003 until April 2005. Mr. Aldinger also served as Chairman and Chief Executive Officer of Household International (now HSBC Finance Corporation) from 1994 until April 2005. Mr. Aldinger is a director of MasterCard International, a global payments solutions company; Illinois Tool Works, Inc., a developer and processor of engineered components, industrial systems and consumables; AT&T, Inc., a voice, video and data communications company; and KKR Financial Corp., a real estate finance company. Mr. Aldinger’s term expires in 2007.

NANCY H. BECHTLE

DIRECTOR SINCE 1992

Ms. Bechtle, age 68,74, served as President and Chief Executive Officer of the San Francisco Symphony from 1987 until 2001 and has served as a member of the San Francisco Symphony Board of Governors since 1984. She was a director and Chief Financial Officer of J.R. Bechtle & Co., an international consulting firm, from 1979 to 1998. Ms. Bechtle has served as Chairman and a director of Sugar Bowl Ski Corporation, a ski resort operator, since 1998. She was appointed a director of the Presidio Trust in 2008 and currently serves as its Chairman. She also has served as Vice Chairman and a director of the National Park Foundation since February 2005.from 2002 until 2008 and was its Vice Chairman from 2005 until 2008. Ms. Bechtle is a nominee for election this year.

Ms. Bechtle brings leadership skills and financial experience to the board, having served as Chief Financial Officer of J.R. Bechtle & Co., Chairman of Sugar Bowl Corporation and Chief Executive Officer of the San Francisco Symphony. She has deep knowledge of the company and its business, having served on our board since 1992.

WALTER W. BETTINGER II

DIRECTOR SINCE 2008

Mr. Bettinger, age 51, has served as President and Chief Executive Officer of The Charles Schwab Corporation and a member of the Board of Directors since 2008. He also serves as Chief Executive Officer and a member of the Board of Directors of Charles Schwab Bank and Charles Schwab & Co., Inc., and as a trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Laudus Trust, Laudus Institutional Trust, and Schwab Strategic Trust, all registered investment companies. Prior to assuming his current role, he served as President and Chief Operating Officer of the company. He also served as Executive Vice President and President – Schwab Investor Services from 2005 until 2007, Executive Vice President and Chief Operating Officer – Individual Investor Enterprise from 2004 until 2005, Executive Vice President and President – Corporate Services from 2002 until 2004 and Executive Vice President and President – Retirement Plan Services from 2000 until 2002. Mr. Bettinger joined the company in 1995 as part of the acquisition of The Hampton Company, which he founded in 1983. Mr. Bettinger is a nominee for election this year.

Mr. Bettinger has significant financial services experience, having served in a senior executive role overseeing sales, service, marketing and operations. As Chief Executive Officer of the company, Mr. Bettinger works closely with the board in evaluating and enhancing the strategic position of the company.

2

C. PRESTON BUTCHER

DIRECTOR SINCE 1988

Mr. Butcher, age 67,73, has been Chairman and Chief Executive Officer of Legacy Partners (formerly Lincoln Property Company N.C., Inc.), a real estate development and management firm, since 1998.1998 and Chairman of the Board, Chief Executive Officer and Director of KBS Legacy Partners Apartment REIT, Inc., a real estate investment trust, since 2009. Mr. Butcher served as President, Chief Executive Officer and Regional Partner of Lincoln Property Company N.C., Inc. from 1967 until1998.until 1998. He is a director of Northstar Realty Finance Corp. Mr. Butcher is a nominee for election this year.

DONALD G. FISHER

DIRECTOR SINCE 1988

Mr. Fisher, age 77, isButcher brings leadership skills and experience in complex financial transactions to the founder of Gap Inc., a nationwide specialty retail clothing chain. He is a directorboard as Chairman and Chairman Emeritus of the Board of Gap Inc. He also was Chief Executive Officer of Gap Inc. from 1969 to 1995. Mr. Fisher is a memberLegacy Partners. He has deep knowledge of the California State Board of Educationcompany and its business, having served on the Advisory Council for the Office of the U.S. Trade Representative from 1987 until 1998. Mr. Fisher’s term expires in 2007.

our board since 1988.

FRANK C. HERRINGER

DIRECTOR SINCE 1996

Mr. Herringer, age 63,69, has been Chairman of the Board of Transamerica Corporation, a financial services company, since 1996. He served as Chief Executive Officer of Transamerica from 1991 to 1999 and President from 1986 to 1999, when Transamerica was acquired by AegonAEGON N.V. From the date of the acquisition until 2000, Mr. Herringer served on the Executive Board of AegonAEGON N.V. and as Chairman of the Board of Aegon U.S.A.AEGON USA, Inc. Mr. Herringer is also a director of AEGON U.S. Corporation, the holding company for AEGON N.V.’s operations in the United States, Amgen Inc., a biotechnology company; Mirapoint,company, Safeway, Inc., an Internet message infrastructure equipment developer;a food and Hawaii Biotech, Inc.,drug retailer, and Cardax Pharmaceuticals, a biotechnology company. Mr. Herringer’s term expires in 2008.2014.

MARJORIE MAGNER

DIRECTOR SINCE JANUARY 2006

Ms. Magner, age 56,Mr. Herringer brings public company knowledge and leadership experience to the board, having served as Chairman and Chief Executive Officer of Transamerica, and his service at Transamerica and AEGON contribute to his knowledge of the Global Consumer Group for Citigroup, Inc., a financial services industry. Mr. Herringer brings insights to our board from his service on other public company from 2003 until October 2005. Ms. Magner joined Commercial Credit, a predecessor company to Citigroup, in 1987. She served as Chief Administrative Officer and Senior Executive Vice President, Global Consumer Group from 2000 until 2002, and Chief

9

THE BOARD OF DIRECTORS

Operating Officer, Global Consumer Group from 2002 until 2003. Ms. Magner is a director of Gannett Company, Inc., a publishing company, and Accenture Ltd, a management consulting and technology services company. She also serves as Chairman of the Brooklyn College Foundation Board of Trustees and is a member of the Dean’s Advisory Council of the Krannert School of Management at Purdue University. Ms. Magner is a nominee for election this year.

boards.

STEPHEN T. MCLIN

DIRECTOR SINCE 1988

Mr. McLin, age 59,65, has been Chairman and Chief Executive Officer of STM Holdings LLC, which offers merger and acquisition advice, since 1998. From 1987 until 1998, he was President and Chief Executive Officer of America First Financial Corporation, a finance and investment banking firm, and parent of EurekaBank. Before that, he was an Executive Vice President of Bank of America. Mr. McLin is an advisory director of Headwaters MB, a merchant bank;bank, and Financial Technology Ventures, a private equity fund; and Webify, Inc., a software company.fund. Mr. McLin’s term expires in 2014.

Mr. McLin brings leadership experience to the board, having served as Chief Executive Officer of America First Financial Corporation and having extensive knowledge of the financial services industry through his experience at STM Holdings, LLC, America First Financial Corporation and Bank of America. His financial expertise is critical for his role as Audit Committee Chairman.

ARUN SARIN

DIRECTOR SINCE 2009

Mr. Sarin, age 57, served as Chief Executive Officer of Vodafone Group Plc, a mobile telecommunications company, from 2003 until his retirement in 2008. Beginning in 1984, he held a variety of management positions with Pacific

3

Telesis Group, a telecommunications company, and AirTouch Communications, Inc., a wireless telecommunications company, which was spun off from Pacific Telesis Group in 1994. He was appointed President and Chief Operating Officer of AirTouch in 1997. In 1999, Mr. Sarin was appointed Chief Executive Officer of Vodafone’s US/AsiaPacific region. He left Vodafone in 2000 to become Chief Executive Officer of Infospace, Inc., an information technology company. From 2002 until 2003, he served as Chief Executive Officer of Accel-KKR Telecom, a private equity firm. He served as a non-executive director of the Court of the Bank of England from 2005 until May 2009. He currently serves as senior advisor for KKR. Mr. Sarin is a director of Cisco Systems, Inc., a networking and communications technology company, and Safeway, Inc., a food and drug retailer. Mr. Sarin’s term expires in 2013.

Mr. Sarin brings public company knowledge and leadership experience to the board, having served as President and Chief Operating Officer of AirTouch Communications, Inc. and Chief Executive Officer of Vodafone Group Plc. He brings insights to our board from his service on other public company boards.

CHARLES R. SCHWAB

DIRECTOR SINCE 1986

Mr. Schwab, age 68,74, has been Chairman and a director of The Charles Schwab Corporation since its incorporation in 1986. Mr. Schwab was re-appointedserved as Chief Executive Officer of the company in July 2004.from 1986 to 1997 and from 2004 until 2008. He served as Co-Chief Executive Officer of the company from 1998 to 2003, and Chief Executive Officer of the company from 1986 to 1997.2003. Mr. Schwab was a founder of Charles Schwab & Co., Inc. in 1971, has been its Chairman since 1978, and served as its Chief Executive Officer since July 2004.from 2004 until 2008. Mr. Schwab is currently a director of U.S. Trust Corporation and United States Trust Company of New York (which are subsidiaries of The Charles Schwab Corporation). He is also Chairman of Charles Schwab Bank N.A., and aChairman and trustee of The Charles Schwab Family of Funds, Schwab Investments, SchwabCapitalSchwab Capital Trust, Schwab Annuity Portfolios, Laudus Trust and Schwab Annuity Portfolios,Laudus Institutional Trust, all registered investment companies. Mr. Schwab’s term expires in 2008.2013.

Mr. Schwab is the founder of the company, was the Chief Executive Officer of the company, and has been the Chairman since its inception. His vision continues to drive the company’s growth.

PAULA A. SNEED

DIRECTOR SINCE 2002

Ms. Sneed, age 58, has been64, is Chairman and Chief Executive Officer of Phelps Prescott Group, LLC, a strategy and management consulting firm. She served as Executive Vice President, Global Marketing Resources and Initiatives, of Kraft Foods, Inc., a nationalglobal food packagingand beverage company, since July 2005. She served asfrom 2005 until her retirement in 2006; Senior Vice President, Global Marketing Resources and Initiatives from 2004 to 2005; and Group Vice President and President of E-Commerce and Marketing Services for Kraft Foods North America, part of Kraft Foods, Inc., from 2000 until 2004, and Senior Vice President, Global Marketing Resources and Initiatives from December 2004 to July 2005.2004. She joined General Foods Corporation (which later merged with Kraft Foods) in 1977 and has held a variety of management positions, including Vice President, Consumer Affairs; SeniorChief Marketing Officer, Executive Vice President and President Foodservice Division;Desserts division, and Executive Vice President and General Manager, Desserts Division; Executive Vice President and General Manager, Dinners and Enhancers Division; Senior Vice President, Marketing Service and Chief Marketing Officer; and Executive Vice President, President E-Commerce Division.eCommerce division. Ms. Sneed is a director of Airgas, Inc., a national distributor of industrial, medical and specialty gases and related equipment.equipment, and TE Connectivity, Ltd., a manufacturer of engineered electronic components, network solutions, wireless systems and telecommunications systems. Ms. Sneed’s term expires in 2007.2013.

Ms. Sneed brings marketing skills and general management and leadership experience to the board, having served as Executive Vice President, Global Marketing Resources and Initiatives, of Kraft Foods, her other management positions at Kraft, and as Chairman and Chief Executive Officer of Phelps Prescott Group. She brings insights to our board through her service on other public company boards.

4

ROGER O. WALTHER

DIRECTOR SINCE 1989

Mr. Walther, age 70,76, has served as Chairman and Chief Executive Officer of Tusker Corporation, a real estate and business management company, since 1997. He served as Chairman and Chief Executive Officer of ELS Educational Services, Inc., a provider in the United States and internationally of courses in English as a second language, between 1992 and 1997. Mr. Walther was President, Chief Executive Officer and a director of AIFS, Inc., which designs and markets educational and cultural programs internationally, from 1964 to February 1993.

10

THE BOARD OF DIRECTORS

Since 1985, Mr. Walther has served as Chairman and has been a director of First Republic Bank.Bank from 1985 until 2007. Mr. Walther’s term expires in 2008.2014.

Mr. Walther brings public company knowledge, leadership, and financial services industry experience to the board, having served as Chairman and Chief Executive Officer of Tusker Corporation, Chairman and a director of First Republic Bank, Chief Executive Officer of ELS Educational Services, Inc. and Chief Executive Officer of AIFS, Inc.

ROBERT N. WILSON

DIRECTOR SINCE 2003

Mr. Wilson, age 65, has been71, is Chairman of MEVION Medical Systems (formerly Still River Systems), a medical device company. Mr. Wilson was Chairman of Caxton Health Holdings, LLC, a healthcare-focused investment firm, since April 2004. Prior to his association with Caxton Health Holdings, Mr. Wilsonfrom 2004 through 2007, and was Vice Chairman of the board of directors of Johnson & Johnson, a manufacturer of health care products, from 1989 until 2003. Mr. Wilson had joined Johnson & Johnson in 1964. Mr. Wilson is also a director of U.S. Trust Corporation and United States Trust Company of New York; Amerada Hess Corporation, an integrated oil and gas company;company, and Synta Pharmaceuticals Corporation, a bio-pharmaceutical company. Mr. Wilson’s term expires in 2008.2014.

Mr. Wilson brings public company knowledge and leadership experience to the board, having served as Vice Chairman of Johnson & Johnson, Chairman of MEVION Medical Systems, and Chairman of Caxton Health Holdings. He brings insights to our board as a director of other public company boards.

DIRECTOR INDEPENDENCE

We have considered the independence of each member of the board in accordance with New York Stock Exchange corporate governance standards. To assist us in our determination, we also adopted general guidelines for independence. The guidelines for independence are available on the company’s website at www.aboutschwab.com/governance.

Based on our guidelines and New York Stock Exchange corporate governance standards, we have determined that the following directors are independent: Nancy H. Bechtle, C. Preston Butcher, Frank C. Herringer, Stephen T. McLin, Arun Sarin, Paula A. Sneed, Roger O. Walther, and Robert N. Wilson.

In determining independence, the Board of Directors considers broadly all relevant facts and circumstances regarding a director’s relationships with the company. All non-employee directors receive compensation from the company for their service as a director, as disclosed in the section “Director Compensation,” and are entitled to receive reimbursement for their expenses in traveling to and participating in board and committee meetings. As disclosed in the “Transactions with Related Persons” section of this proxy statement, some directors and entities with which they are affiliated have credit transactions with the company’s banking and brokerage subsidiaries, such as mortgage loans, revolving lines of credit, or other extensions of credit. These transactions with directors and their affiliates are made in the ordinary course of business and to the extent permitted by the Sarbanes-Oxley Act of 2002. Such transactions are on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not related to the lender and do not involve more than the normal risk of collectability or present other unfavorable features.

DAVID B. YOFFIE5

DIRECTOR SINCE 2003

In addition to the relationships outlined above, the board considered the following types of relationships for the following directors:

Professor Yoffie, age 51, has been the Max and Doris Starr Professor of International Business Administration at the Harvard Business School since 1993 and has been a member of the Harvard University faculty since 1981. Professor Yoffie is also a director of the National Bureau of Economic Research; Intel Corporation, a maker of microcomputer and communications components; and Spotfire, Inc., a provider of analytic and visualization software applications. Professor Yoffie’s term expires in 2007.

| · | | Nancy H. Bechtle: The director serves as a director of a nonprofit organization to which the company, its affiliates or its charitable foundation have made donations. |

| · | | C. Preston Butcher: The director’s spouse serves as a director of a nonprofit organization to which the company, its affiliates or its charitable foundation have made donations. |

| · | | Frank C. Herringer: The director’s spouse serves as a director of a nonprofit organization to which the company, its affiliates or its charitable foundation have made donations. |

| · | | Stephen T. McLin: The director’s son is employed by the company in a non-executive officer, non-managerial capacity. |

| · | | Paula A. Sneed: The director serves as a director of a nonprofit organization to which the company, its affiliates or its charitable foundation have made donations. |

NUMBER OF DIRECTORS AND TERMSCORPORATE GOVERNANCE INFORMATION

Board Leadership

The Chairman of the Board is Charles R. Schwab. The Chairman and Chief Executive Officer roles are split, and Mr. Bettinger serves as Chief Executive Officer. The Chairman of the Board approves the agenda for board meetings and leads the board in its discussions. Mr. Schwab and Mr. Bettinger, as the only two management directors, do not participate in sessions of non-management directors. As provided in our Corporate Governance Guidelines, non-management directors meet regularly in executive session without management. The Chairman of the Nominating and Corporate Governance Committee presides over the executive sessions of non-management directors.Mr. Herringer, as chairman of the Nominating and Corporate Governance Committee in 2011, led the non-management directors in executive session.

The board has three standing committees (Audit, Compensation, and Nominating and Corporate Governance) that are composed entirely of independent directors and are chaired by independent directors. Given the role and scope of authority of these committees, and that 80% of the board is composed of independent directors, the board believes that its leadership structure, with the Chairman of the Board leading board discussions, and the Chairman of the Nominating and Corporate Governance Committee leading non-management executive sessions, is appropriate.

Risk Oversight

As part of its oversight functions, the Board of Directors is responsible for oversight of risk management at the company. Responsibility for oversight of risk management is delegated to the Audit Committee, which reviews with management the company’s major risk exposures and the steps management has taken to monitor and control such exposures, including the company’s risk assessment and risk management policies. The Compensation Committee, as described in the Compensation Discussion and Analysis, separately reviews the compensation program with respect to incentives for risk-taking by employees. For further discussion of risk management at the company, please see “Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations – Risk Management” of the company’s Form 10-K for the period ended December 31, 2011.

Board Structure and Committees

The authorized number of directors is twelvecurrently ten and the company currently has twelveten directors. Three directors are nominees for election this year and nineseven directors will continue to serve the terms described in their biographies.

Our directors6

Directors currently serve staggered terms. ThisEach director who is accomplished as follows:

· | | each director who is elected at an annual meeting of stockholders serves a three-year term, |

· | | the directors are divided into three classes, |

· | | the classes are as nearly equal in number as possible, and |

· | | the term of each class begins on a staggered schedule. |

If the proposal to amend the certificate of incorporation and bylaws to provide for the annual election of directors is approved, directors will be elected annually after their current three-year terms expire, beginning with the 2007 annual meeting.

11

THE BOARD OF DIRECTORS

BOARD AND COMMITTEE MEETINGS

are divided into three classes.

The board held seven regular meetings and one special meeting in 2005.2011. Each director attended at least 75% of all board and applicable committee meetings during 2005. Non-management directors meet regularly in executive session. The chairman of the Nominating and Corporate Governance Committee presides over the executive sessions of non-management directors.2011. As provided in our Corporate Governance Guidelines, we expect directors to attend the annual meeting of stockholders. In 2005, all of the2011, nine directors attended the annual meeting.

We have an Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Each of these committees is composed entirely of “independent directors” as determined by the Board of Directors in accordance with its independence guidelines and New York Stock Exchange corporate governance standards. In addition to those standing committees, the board may from time to time establishad hoc committees to assist in various matters.

This table describesThe Audit Committee held twelve meetings in 2011 and is composed of the board’s standing committees.following members: Stephen T. McLin (Chairman), C. Preston Butcher, and Arun Sarin. None of the directors on the Audit Committee is or has been an employee of The Charles Schwab Corporation or any of its subsidiaries. None of the Audit Committee members simultaneously serves on the audit committees of more than three public companies, including ours. The board has determined that all of the members of the Audit Committee are financially literate in accordance with New York Stock Exchange listing standards and that Stephen T. McLin is an Audit Committee financial expert in accordance with Securities and Exchange Commission rules.

The Audit Committee:

| | | | |

| | |

NAME OF COMMITTEE AND·

MEMBERS(1)

| | FUNCTIONS OF THE COMMITTEE | | NUMBER OF MEETINGS IN 2005 |

| | |

AUDIT

Stephen T. McLin, Chairman(2)

William F. Aldinger III(2)(3)

Nancy H. Bechtle

C. Preston Butcher

Donald G. Fisher

Marjorie Magner(4)

| | ·reviews and discusses with management and the independent auditors the company’s annual and quarterly financial statements and the integrity of the financial reporting process,

|

| · | | reviews the qualifications and independence of the independent auditors and performance of the company’s internal audit function and independent auditors, |

· retains sole authority | | reviews reports from management regarding major risk exposures and steps management has taken to select independent auditors, approve audit feesaddress such exposures, and establish policies and procedures regarding pre-approval of fees for non-audit services |

| · | | reviews compliance with legal and regulatory requirementsrequirements. |

The Compensation Committee held seven meetings in 2011 and is composed of the following members: Roger O. Walther (Chairman), Nancy H. Bechtle, Frank C. Herringer, Paula A. Sneed, and Robert N. Wilson. The Compensation Committee:

| · | | 10

|

| | |

COMPENSATION

Roger O. Walther, Chairman

Frank C. Herringer

Paula A. Sneed

Robert N. Wilson

David B. Yoffie(5)

| | ·annually reviews and approves corporate goals and objectives relating to compensation of executive officers and other senior officers,

|

| · | | evaluates the performance of executive officers and other senior officers and determines their compensation levels, |

| · | | reviews and approves compensatory arrangements for executive officers and other senior officers, and |

| · | | approves long-term awards for executive officers and other senior officersofficers. |

The Nominating and Corporate Governance Committee held two meetings in 2011 and is composed of the following members: Frank C. Herringer (Chairman), Nancy H. Bechtle, C. Preston Butcher, Stephen T. McLin, Arun Sarin, Paula A. Sneed, Roger O. Walther, and Robert N. Wilson. The Nominating and Corporate Governance Committee:

12

THE BOARD OF DIRECTORS

| | | | |

| | |

NAME OF COMMITTEE AND

MEMBERS(1)

| | FUNCTIONS OF THE COMMITTEE | | NUMBER OF MEETINGS IN 2005 |

| | |

NOMINATING AND CORPORATE GOVERNANCE

Frank C. Herringer, Chairman

William F. Aldinger III(3)

Nancy H. Bechtle

C. Preston Butcher

Donald G. Fisher

Marjorie Magner(4)

Stephen T. McLin

Paula A. Sneed

Roger O. Walther

Robert N. Wilson

David B. Yoffie(5)

| | ·identifies and evaluates individuals qualified to serve on the board,

|

| · | | recommends nominees to fill vacancies on the board and each board committee and recommends a slate of nominees for election or re-election as directors by the stockholders, at the annual meeting to fill the seats of directors whose terms are expiring |

7

· leads the board in its annual review of the board’s performance, develops corporate governance principles, policies and procedures and recommends their adoption by the board | | 3makes recommendations regarding succession planning for the Chief Executive Officer and executive management, and

|

(1)· | | In addition toassesses the standingperformance of the board and its committees we may from time to time establishad hoc committees to assist in various matters. and recommends corporate governance principles for adoption by the board. |

(2) | | We have determined that Mr. McLin and Mr. Aldinger are Audit Committee financial experts and “independent” under the Nasdaq Stock Market corporate governance rules and the rules of the Securities and Exchange Commission. |

(3) | | Mr. Aldinger was appointed to the Audit and Nominating and Corporate Governance Committees, effective July 28, 2005. |

(4) | | Ms. Magner was appointed to the Audit and Nominating and Corporate Governance Committees, effective January 26, 2006. |

(5) | | Mr. Yoffie was appointed to the Compensation and Nominating and Corporate Governance Committees, effective March 14, 2006. |

13

THE BOARD OF DIRECTORS

CORPORATE GOVERNANCE INFORMATION

You may find our Corporate Governance Guidelines, Code of Business Conduct and Ethics, and the charters for theThe Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee have written charters. You may find a copy of these charters, as well as our Corporate Governance Guidelines and Code of Business Conduct and Ethics, on the company’s website atwww.aboutschwab.com/governance. You also may obtain a paper copy of these items, without charge, from:

Assistant Corporate Secretary

The Charles Schwab Corporation

Mailstop SF120KNY-04SF211MN-05

101 Montgomery211 Main Street

San Francisco, California 94104

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation Committee (the members of which are listed in the table in the “Board and Committee Meetings” section) is or has been an officer or employee of the company or any of its subsidiaries. There were no Compensation Committee interlocks as defined under Securities and Exchange Commission rules during 2005.

94105

DIRECTOR COMPENSATION

The following table shows compensation paid to each of our non-employee directors during 2011. The company does not provide any non-equity incentive plans, defined benefit and actuarial pension plans, or other defined contribution retirement plans for non-employee directors. The company does not offer above-market or preferential earnings under its nonqualified deferred compensation plans for directors.

All Directors2011 Director Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) | | | | | | | | | | | | | |

| | Paid in

Cash1 ($) | | | Deferred into

Restricted

Stock Units or

Options2,6 ($) | | | Stock

Awards3, 6 ($) | | | Option

Awards4, 6 ($) | | | All Other

Compen-

sation5 ($) | | | Total ($) | |

| | | | | | |

Nancy H. Bechtle | | | 85,500 | | | | — | | | | 62,500 | | | | 62,500 | | | | 1,891 | | | | 212,391 | |

| | | | | | |

C. Preston Butcher | | | — | | | | 90,500 | | | | 62,500 | | | | 62,500 | | | | 1,891 | | | | 217,391 | |

| | | | | | |

Frank C. Herringer | | | — | | | | 100,000 | | | | 62,500 | | | | 62,500 | | | | 1,891 | | | | 226,891 | |

| | | | | | |

Stephen T. McLin | | | 79,000 | | | | 110,500 | | | | 82,500 | | | | 62,500 | | | | 2,496 | | | | 336,996 | |

| | | | | | |

Arun Sarin | | | 90,000 | | | | — | | | | 62,500 | | | | 62,500 | | | | 1,293 | | | | 216,293 | |

| | | | | | |

Paula A. Sneed | | | 85,000 | | | | — | | | | 62,500 | | | | 62,500 | | | | 1,891 | | | | 211,891 | |

| | | | | | |

Roger O. Walther | | | 100,000 | | | | — | | | | 62,500 | | | | 62,500 | | | | 1,891 | | | | 226,891 | |

| | | | | | |

Robert N. Wilson | | | 85,000 | | | | — | | | | 62,500 | | | | 62,500 | | | | 1,891 | | | | 211,891 | |

All directors are reimbursed first-class air travel, hotel, meals and related expenses for attending board and committee meetings.

| (1) | | This column shows amounts paid in cash for retainers and meeting fees. For Mr. McLin, the amount in this column represents his cash retainer and fees for service on the Charles Schwab Bank board of directors. |

| (2) | | This column shows the dollar amount of retainers and meeting fees deferred into restricted stock units or options under the Directors’ Deferred Compensation Plan II. The corresponding restricted stock units or options were as follows: 21,605 stock options for Mr. Butcher, 26,385 stock options for Mr. McLin, and 6,564 restricted stock units for Mr. Herringer. |

Employee Directors8

| (3) | | The amounts shown in this column represent the grant date fair value of the restricted stock unit award. In 2011, all non-employee directors received an automatic grant of restricted stock units with a grant date fair value of $62,500. In addition, Mr. McLin received a grant of restricted stock units with a grant date fair value of $20,000 for his service on the Charles Schwab Bank board. |

| (4) | | The amounts shown in this column represent the grant date fair value of the option award. In 2011, all non-employee directors received an automatic grant of stock options with a grant date fair value of $62,500. |

Directors who are also employees receive

| (5) | | This column shows the dollar amount of cash dividends on unvested restricted shares and dividend equivalents on unvested restricted stock units. |

| (6) | | The following table shows the aggregate number of outstanding restricted stock, stock option and restricted stock unit awards granted to the non-employee directors as of December 31, 2011: |

| | | | | | | | | | | | |

| Name | | Restricted Stock

Awards | | | Stock Option

Awards | | | Restricted Stock

Unit Awards | |

| | | |

Nancy H. Bechtle | | | 1,780 | | | | 93,901 | | | | 6,832 | |

| | | |

C. Preston Butcher | | | 1,780 | | | | 278,721 | | | | 33,708 | |

| | | |

Frank C. Herringer | | | 1,780 | | | | 92,669 | | | | 87,612 | |

| | | |

Stephen T. McLin | | | 2,350 | | | | 166,615 | | | | 38,144 | |

| | | |

Arun Sarin | | | — | | | | 24,000 | | | | 6,562 | |

| | | |

Paula A. Sneed | | | 1,780 | | | | 90,463 | | | | 49,964 | |

| | | |

Roger O. Walther | | | 1,780 | | | | 76,843 | | | | 33,872 | |

| | | |

Robert N. Wilson | | | 1,780 | | | | 91,559 | | | | 54,386 | |

During 2011, Mr. Schwab and Mr. Bettinger received no additional compensation for their service as directors.

Non-Employee Directors

Non-employee directors received the following retainers in 2011:

Cash Retainers

Each non-employee director received an annual cash retainer in the amount of $85,000. In addition, the Chair of the Audit Committee received an annual cash retainer of $25,000, and each other member of the Audit Committee received an annual cash retainer of $5,000. The Chair of the Compensation Committee and the Chair of the Nominating and Corporate Governance Committee each received an annual cash retainer of $15,000. There are no fees in 2005:for attendance at board or committee meetings, but the board retains the discretion to establish special committees and to pay a special retainer to the Chair and the members of any special committee. The board has authorized meeting fees for service on a special committee by Ms. Bechtle, Mr. Butcher and Mr. McLin. The meeting fees for that special committee consisted of $500 per meeting held on the same day as a board meeting and $2,000 per meeting held on a day other than a board meeting.

| | | |

| Non-Employee Director Retainers and Fees |

| |

Annual retainer | | $ | 50,000 |

| |

Attendance fee for each board meeting | | $ | 2,800 |

| |

Attendance fee for each Audit Committee and Compensation Committee meeting held on the same day as a board meeting | | $ | 1,000 |

| |

Attendance fee for each other board committee meeting held on the same day as a board meeting | | $ | 500 |

| |

Attendance fee for each Audit Committee and Compensation Committee meeting held on a day other than a board meeting | | $ | 2,500 |

| |

Attendance fee for each other board committee meeting held on a day other than a board meeting | | $ | 2,000 |

| |

Additional annual retainer for service as Audit Committee chairman | | $ | 20,000 |

| |

Additional annual retainer for service as a board committee chairman other than the Audit Committee | | $ | 15,000 |

Equity Grants

Non-employee directors also are entitled to receive non-discretionaryEach non-employee director received an annual equity grantsgrant under the 2004 Stock Incentive Plan which was approved by stockholderswith an aggregate value of $125,000. Non-employee directors received the equity grant 50 percent in May 2004. In 2005, non-employee directors were entitled to grants as follows:stock options and 50 percent in restricted stock units.

| | |

Non-Employee Director Equity Grants |

| |

Annual grant of options

| | 5,000 options |

| |

Annual grant of restricted stock

| | 5,195 shares |

| |

Initial grant of options for new directors

| | 10,000 options |

149

THE BOARD OF DIRECTORSTerms and Conditions